By Carolyn Kousky and Brett Lingle

[...]

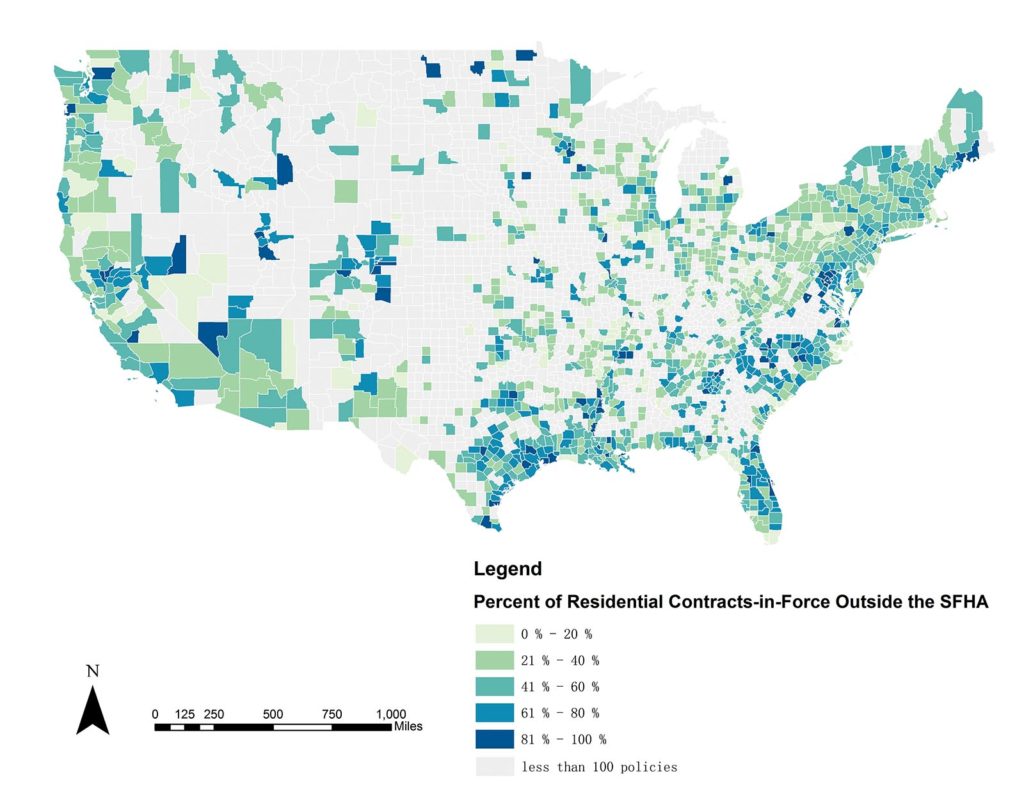

While take-up rates in many parts of the country remain low for flood insurance, there are places where many households are insured and, surprisingly, places where most flood insurance is purchased outside of the FEMA-mapped high-risk areas. We offer three findings about residential NFIP purchases as demonstrated in three maps. All the data is from February, 2018.

[...]

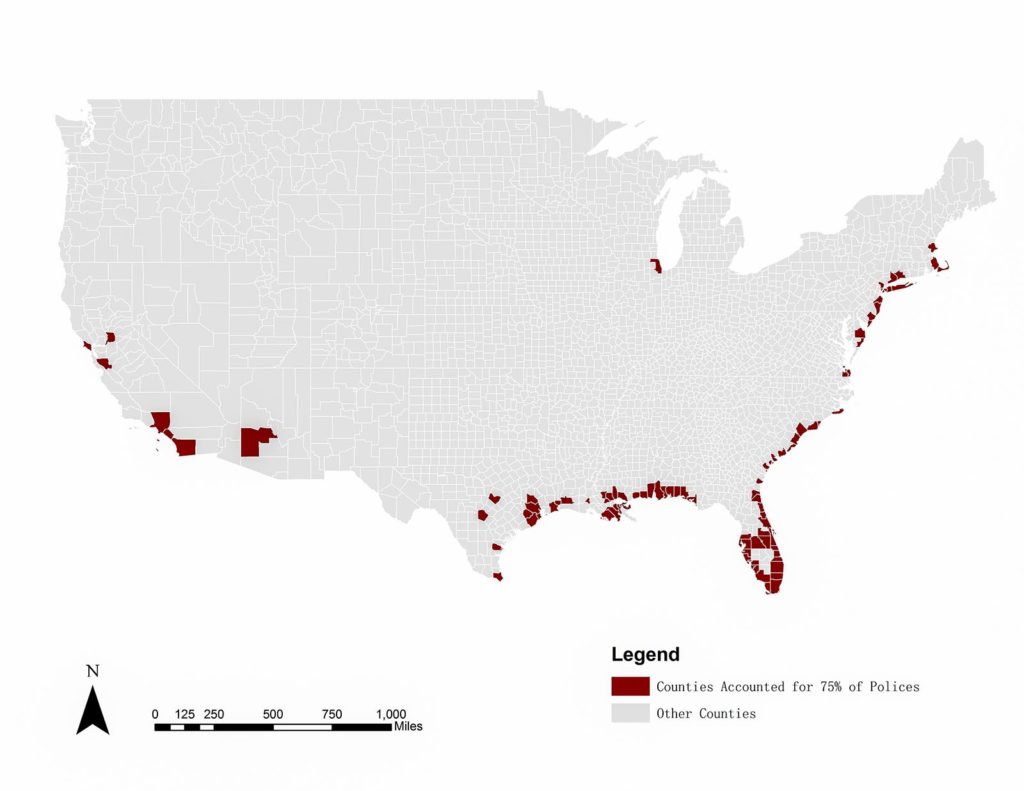

Figure 1. Residential flood insurance is concentrated in a few areas, largely along the Gulf and East coast

[...]

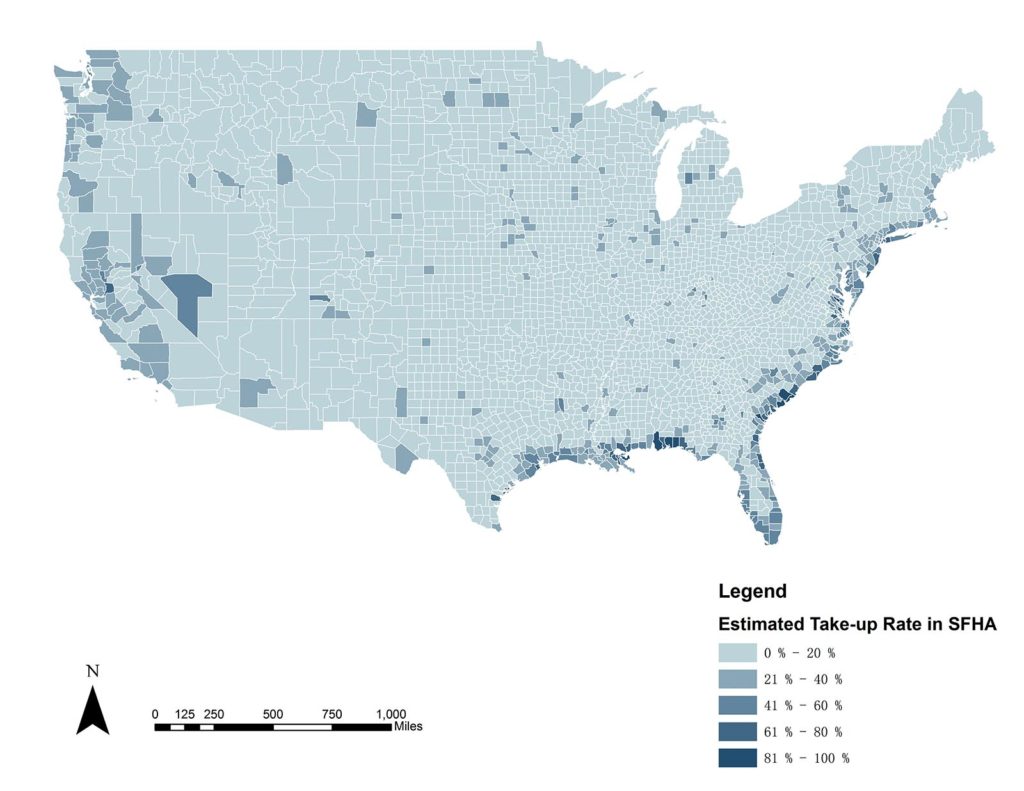

Figure 2. Take-up rates for flood insurance among residential properties is generally low, with a few exceptions usually in coastal areas

[...]

Figure 3. In a few counties around the country, the majority of residential flood insurance is purchased by homeowners outside the highest-risk areas

[...]