Why do we need a new view to understand the systemic nature of risk?

This is the second in a series of eight articles co-authored by Marc Gordon (@Marc4D_risk), UNDRR and Scott Williams (@Scott42195), building off the chapter on ‘Systemic Risk, the Sendai Framework and the 2030 Agenda’ included in the Global Assessment Report on Disaster Risk Reduction 2019. These articles explore the systemic nature of risk made visible by the COVID-19 global pandemic, what needs to change and how we can make the paradigm shift from managing disasters to managing risks.

A paradigm shift has occurred since the mid-twentieth century. Computational power has increased. We can mobilize vast streams of data and observations. New systems-based models and narratives are emerging. Systems approaches help make sense of a world where everything is connected. The pervasive linear process of resource use (extraction–production–distribution–consumption–disposal) defines the current economic paradigm. But as the COVID-19 pandemic demonstrates, Earth is one system – a system of systems. Systems thinking and being able to adopt a systemic perspective when making decisions is obvious and essential to create the future enshrined in the 2030 Agenda for Sustainable Development.

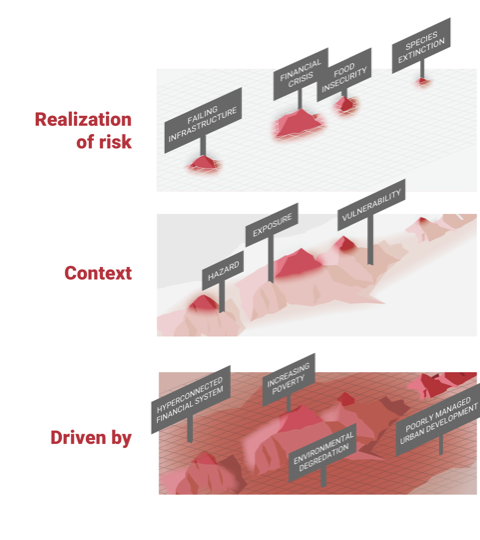

The era of hazard-by-hazard risk reduction is over. We need to reflect the systemic nature of risk in how we deal with it. We need to improve our understanding of anthropogenic systems in nature. We must identify precursor signals and correlations to better prepare, anticipate and adapt.

The traditional understanding of risk is like a view of the Himalayan peaks from above, with cloud cover that obscures the topography below. From above, humans have described and named these peaks of risk as if they are separate and independent. In fact, below the clouds, the connections are clear. Significant and influential peaks of risk occur that do not rise above the clouds. These are currently invisible; but are nonetheless relevant.

By definition, systemic risks like COVID-19 are emergent. They are not necessarily obvious using contemporary hazard-plus-hazard approaches. We may not see them until the initial events build into a disaster affecting systems upon which our lives depend on.

Emergent risks can be obvious in retrospect. They are the result of a series of events that cross human-imposed boundaries, whether institutional, geographic, disciplinary, conceptual or administrative. The term “emergent risk” is common in the realm of financial systems. For example, when one significant financial institution fails and others collapse because of opaque, complex, coupled relationships that connect them. In banking, emergent risks may be the result of large interbank deposits, net settlement payment systems, investor panic or counterparty risk on derivative transactions, such as credit default swaps.

Likewise, the “disease fixing” medical establishment is not well suited for preventive, holistic approaches to good health and happiness. And in many instances, it has created new ills while curing old ones. Similarly, traditional disaster response and mitigation capabilities are not the appropriate apparatus to increase community and societal resilience or to contribute to a better understanding of systemic risks. We have seen a growing number of major infectious disease epidemics this century - SARS, MERS, H1N1, H5N1, and Ebola. Yet, COVID-19 has shown that much more is required for appropriate and proportionate readiness for a global pandemic.

Paragraph 36(c) of the Sendai Framework stresses the role of the private sector and financial institutions. It calls for integrating disaster risk management into core business models, changing established practices, and increasing focus on disaster risk-informed investments. The main challenge of changing business and investor behaviour is the different time horizons of the available modelling. For instance, climate change models tend to focus on long-run horizon scenarios of development. Often models focus out to 2100. Meanwhile financial market activity focuses on daily, quarterly, annual or, at best, multi-annual time horizons.

The UN Secretary-General’s Special Envoy on Climate Action and Finance, and former Governor of the Bank of England, Mark Carney referred to this as “the tragedy of the horizon”. This is a tragedy now playing out through the global economy and financial markets as a result of COVID-19. Financial institutions and private sector businesses have failed to recognize, or have been unable to recognize, the risk that had been accumulating. Whilst this is true of private sector institutions, it is also prevalent in public sector institutions at all levels.

Scenario building in this context can help facilitate more systemic thinking and decision-making. Particularly if those involved are able to consider local events and regional and global drivers. Exploratory scenarios start with the present situation and explore the future impacts of various drivers. These drivers may include environmental degradation, climate change, shocks such as disasters or trends such as urbanization and migration.

Understanding the degree of cascading risk and developing ways to isolate, measure and manage or prevent systemic risk is a new challenge. The interconnectedness of the connective tissue that runs through all of today’s systems amplify this challenge. This includes the digital infrastructure, which is susceptible to breakdowns and attacks from malicious third parties.

Models that can only describe single-system vulnerabilities for complex risk scenarios are not helpful for decision makers to understand and prepare for systemic risks. Policy makers currently face this across the world with the COVID-19 pandemic. By contrast, we do not have models that can describe the degree of risk expansion, as interrelated systems propagate the outbreak of such risks deep into the ecosystem of society. Such models could begin to provide risk information helpful to inform governments, citizens, and businesses action. Action and appropriate preventative measures can then be taken to prevent the conditions for pandemics, or to better manage the interdependent system components that are potentially vulnerable.

Measuring and modelling systemic risks

Established risk management techniques deal with threats generated by factors external to the situation at hand. These are also termed as “exogenous” factors. Typically, such situations allow a separation between risk assessment and risk management. Repetitive historical observations are used to characterize risk with statements about the probability of certain interactions of hazards, vulnerability, exposure and capacity. Yet, the essential feature of an extreme, catastrophic risk, such as the COVID-19 pandemic, is the lack (or complete absence) of the patterns expected based on historical observations.

The complexity that underlies systemic risk may be so intricate that quantification and prediction of risk is not easy. Or not possible. In many instances, the capacity to make pertinent real-world observations is limited or absent. We need an improved understanding of systems to elaborate valid estimates that can inform sound decision-making. Systemic risk modelling may offer quantitative information to estimate spatio-temporal hazard exposures and potential catastrophic impacts. The design and computation of such models is a multidisciplinary, transcontextual, enquiry-based endeavour. It raises scientific challenges and important judgments about what to include and what to exclude.

To make our complex, interconnected systems more manageable, we need a new view of risk. This would help clear away the cloud cover to reveal the three-dimensional shape of risk; with a topography that also shifts through time. The Sendai Framework impels a move away from an obsession with prediction and control, calling us to embrace multiplicity, ambiguity and uncertainty. We need a view of the full topography of risks through time to be better prepared for the challenges of global events such as the COVID-19 pandemic.

The next article in this series will explore the differences between ‘complicated’ and ‘complex’ systems. And why this is so important for public policy and decision-making in the context of systemic risks, as the COVID-19 pandemic continues to challenge conventional approaches to risk management and policy responses.