Unprecedented urbanization is transforming the planet and the way we live:

- For the first time in history, more people live in cities than in rural areas.

- Ninety percent of this urban expansion takes place in developing countries, and much of it occurs near natural hazards, rivers and coastlines, and through informal and unplanned settlements.

- Poorly managed urbanization can exacerbate existing challenges and leave cities more vulnerable to natural hazards.

The greater concentration of people and assets means that the impact of natural disasters and a changing climate can be devastating, both in terms of human lives lost and economic livelihoods destroyed.

The poorer segments of the population are particularly vulnerable, as they tend to live in more hazardous settlements and lack the necessary safety nets to recover from economic or environmental shocks. Preparing cities for disaster and climate risks and strengthening urban resilience is fundamental to ensuring sustainable development and poverty reduction.

The World Bank Group’s (WBG) City Resilience Program (CRP) is an effort to assist city governments to build greater resilience to climate and disaster risks.

For many cities around the world, strengthening urban resilience is a multibillion-dollar agenda that requires strong partnerships and new sources of capital. Cities are sometimes held back from pursuing the necessary investments because they lack the technical expertise and/or the access to capital to finance them.

CRP tries to fill that gap by:

- Leveraging the WBG’s broad set of sectoral expertise in designing urban resilience projects

- Better connecting cities to the necessary financing

CRP aims to catalyze a transparent pipeline of well-prepared and bankable investments to enhance urban resilience, and to improve access for private and institutional investors to crowd into new markets. CRP acts as the banker of the city, and facilitate strategic investments that address the vulnerabilities and risks that cities face in a holistic way.

1. Designing a Better Project

CRP seeks to promote a multi-sectoral approach toward enhancing resilience and strengthening urban planning. Working closely with cities, CRP gains a better understanding of their disaster risk profiles and provides capacity development and technical assistance in urban planning, infrastructure development, capital investment planning, and project development.

CRP draws from a broad set of expertise and integrates best practice and innovation in project design and implementation. The aim is to conceive more ambitious interventions and to shift away from traditional sector-specific programs toward programs that improve resilience holistically and incorporate infrastructure investments, geospatial solutions, emergency preparedness and response systems, etc.

2. Financing a Bigger Project

Many cities lack the capacity to maximize their financing options and exploit investment opportunities. City governments need assistance in structuring investments and raising the necessary capital to realize ambitious and transformative investment programs. CRP connects city governments with multilateral development banks, bilateral donors, and private investors, with particular emphasis on building the capacity of cities to raise capital through PPPs, concessions, and land value capture transactions.

At the same time, CRP focuses on increasing investors’ confidence by exploring a suite of risk-mitigation tools, such as guarantees or credit enhancements to boost the “bankability” of projects. As a result, CRP helps reduce transaction costs through supporting market reconnaissance, providing capacity-building to governments to move toward investment readiness, and facilitating the negotiation between cities and investors on specific transaction opportunities.

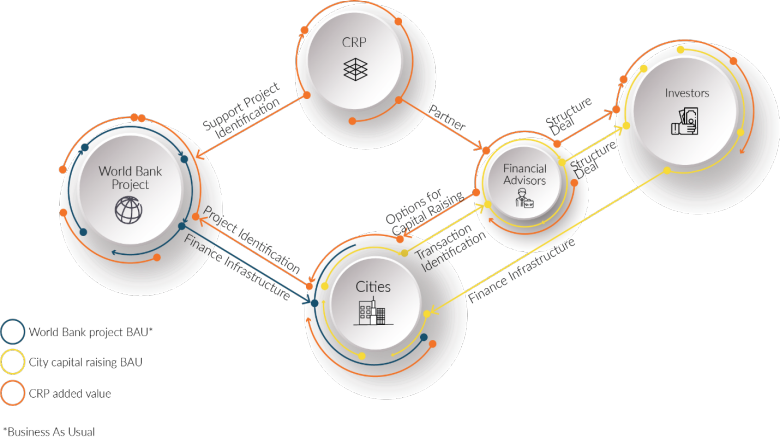

Figure 2: Financing a Bigger Project

The CRP approach engages cities in a long-term partnership to identify areas of need and opportunity and to define a robust response toward building resilience. The broad coalition of experts that accompanies each city-level engagement ensures the design and implementation of a comprehensive response to the resilience strategy. Private capital experts support cities to develop a pipeline of resilience-building investments and expand the financing options available to them. As such, CRP generates urban resilience investments that are “bigger and better” by enhancing both the technical design as well as the bankability of engagements.

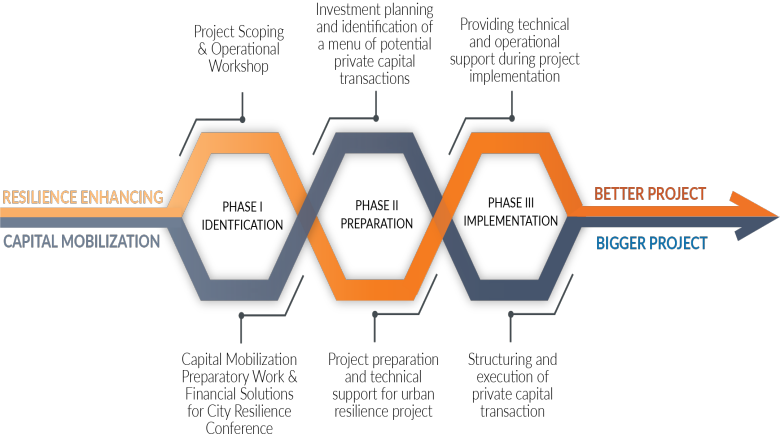

CRP’s comparative advantage lies in its structure around three phases as described below:

Figure 3: CRP Program Approach

PHASE I – IDENTIFICATION

Urban Resilience Support:

- Conducting preliminary assessments to define the set of investments needed to strengthen urban resilience (“City Diagnostics”)

- Investment Planning Workshop that facilitates articulation of a menu of priority infrastructure investments and project proposals that could be financed

Capital Mobilization:

- Conducting a set of diagnostics to assess the city’s enabling environment for private capital mobilization through Debt, PPP and Land Value Capture (“Rapid Capital Assessments” and “City Creditworthiness Assessments”).

- Financial Solutions Conference to explore concrete investment opportunities and move toward private capital engagement for investment plans

PHASE II – PREPARATION

Urban Resilience Support: Preparation and technical support for urban resilience project preparation

Capital Mobilization: Investment planning and identification of a menu of potential private capital transactions

PHASE III – IMPLEMENTATION

Urban Resilience Support: Technical and operational support for project implementation

Capital Mobilization: Structuring and executing of private capital transaction

Progress to Date

City Engagement: Since its launch in June 2017, CRP has engaged with over 40 cities across the world to develop investment programs that could be financed with a range of financial instruments. In January 2018, 12 cities from CRP’s first cohort have already been selected for market testing. City engagement is ongoing and includes both technical support and advisory services to unlock investment opportunities. In February 2018, 19 cities joined the second cohort, and about 15 cities have already expressed interest to be part of the third cohort.

Financial Solutions for City Resilience Conference: The first Financial Solutions for City Resilience Conference took place in November 2017 and brought together officials from 24 cities, private capital experts and investors to identify concrete investment opportunities and connect them to appropriate financing options. The second conference takes place in July 2018.

Future Outlook: In the long term, CRP aims to create an ecosystem where investment opportunities in cities in the global South form part of any attractive investment portfolio. If CRP is successful, 10 years into the future this will become business as usual, not the frontier of complexity and opportunity.

Opportunities for Contribution

CRP continually engages with bilateral and multilateral development financing institutions for potential interest to join the partnership, through: i) financial support to the core program; ii) targeted diagnostic support in earmarked cities; iii) co-financing of investment projects; and iv) support to a credit enhancement facility.

The City Resilience Program is supported by the Global Facility for Disaster Reduction and Recovery (GFDRR). To learn more about CRP, click here.