Climate financial preparedness in the Philippines

Summary

The Philippines faces frequent and severe natural hazards, affecting most of its land and population, leading to significant economic losses. In response, the government enacted the Disaster Risk Reduction and Management Act in 2010 and later adopted a Disaster Risk Finance and Insurance (DRFI) strategy in 2015, aiming to strengthen fiscal resilience and disaster preparedness through partnerships with the World Bank and other international entities.

This case study is an abridged version of the chapter 'Comprehensive financial preparedness in the Philippines' published in the 2024 World Bank Report 'Rising to the Challenge: Success Stories and Strategies for Achieving Climate Adaptation and Resilience' (read from p.120) - which can be downloaded from the right-hand column. We highlight some of the chapter's key messages below, but please access the original text for more comprehensive detail, full references, or to quote text.

Introduction

The Philippines is a highly disaster-prone country. At least 60 percent of its land area and close to 74 percent of its population are exposed to multiple natural hazards, including typhoons, earthquakes, floods, storm surges, tsunamis, volcanic eruptions, and landslides. Over the past 30 years, disasters have claimed the lives of 33,000 people and adversely affected 120 million people. It is estimated that earthquakes and typhoons cause an average of $3.5 billion annually in direct losses to public and private assets, amounting to over 1 percent of GDP. Climate change is expected to increase the frequency and severity of hydromet events, with recent estimates from climate modeling exercises showing that emergency response costs from typhoons could rise by over 50 percent for severe events. Disaster-related risk is heavily concentrated in the Metro Manila Region due to population concentration.

To increase disaster resilience, the government undertook a comprehensive reform journey. Starting over a decade ago, with the enactment of the 2010 Philippines Disaster Risk Reduction and Management Act, it took several more years for the country to conceptualize its financial resilience strategy. This was crucial, as from 2015 to 2018, the government spent an average of 4.3 percent of its total budget allocations each year on disaster response and rehabilitation.

Adaptation strategies

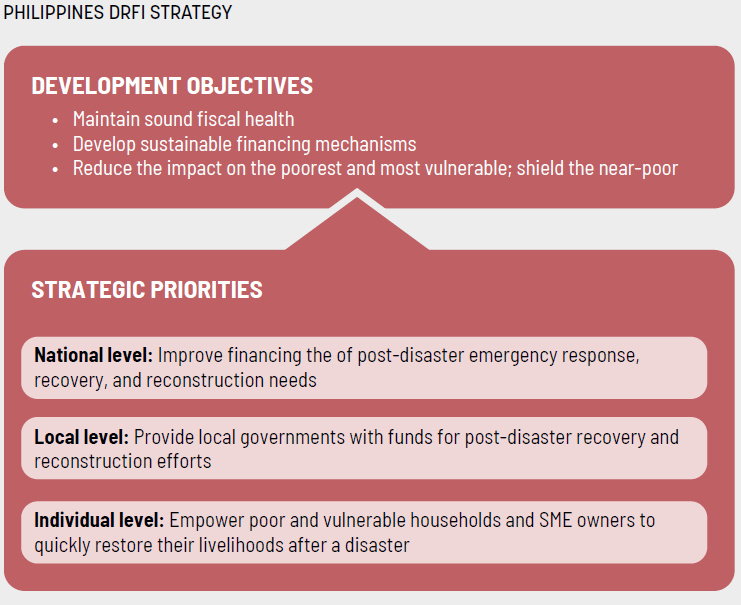

Following the destruction brought by Typhoon Haiyan, which severely impacted Tacloban City, the Philippine government adopted a disaster risk finance and insurance (DRFI) strategy in 2015. The strategy builds on a country-specific catastrophe risk model developed by the Department of Finance with World Bank support and focuses on three elements:

- Maintaining the national government's sound fiscal health even after a disaster;

- Developing sustainable local government financing mechanisms, and;

- Reducing the impact of disasters on the poorest and most vulnerable.

Philippines DRFI Strategy (pg. 121)

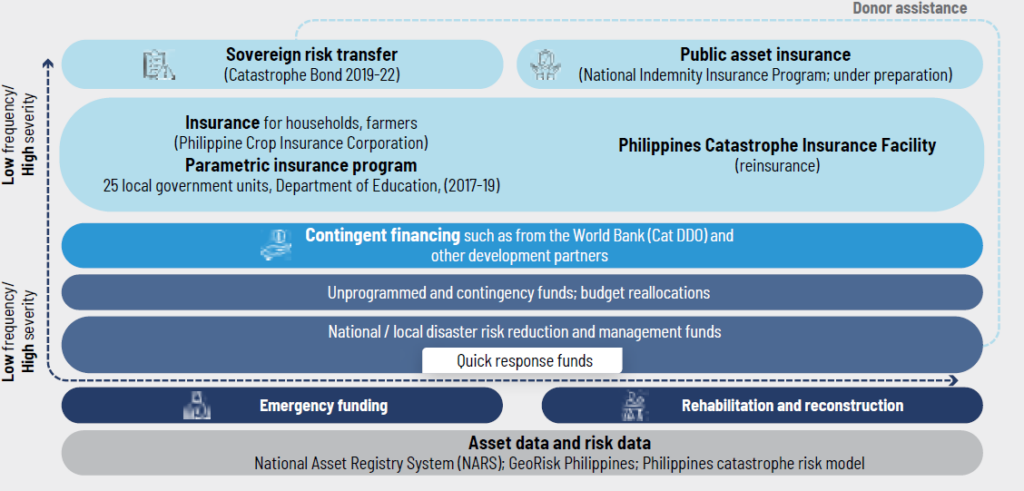

Since adopting the DRFI strategy, the country has introduced multiple initiatives to enhance disaster preparedness using a multilevel risk-layering approach. For example, the government has put in place contingent financing, from the World Bank and other partners, to provide immediate liquidity to help the government manage the financial impacts of disasters, and secured over $14 billion in risk transfer protection to improve fiscal resilience, including through a catastrophe bond, a parametric insurance program for local government units, and the 2024 National Indemnity Insurance Program (NIIP), which protects more than 130,000 schools. It has also instituted local disaster risk reduction and management funds, requiring local governments to set aside no less than 5 percent of their estimated revenues from regular sources, and established a parametric insurance program to transfer typhoon and earthquake risk away from the country to the international reinsurance market in local currency. Finally, at individual level, it provides support to make agricultural insurance more affordable for Philippine farmers, especially the most vulnerable.

Having implemented the DRFI strategy, the government is now working to embed disaster risk considerations in its day-to-day operations-including asset management and the budget lifecycle-to ensure the sustainability of its risk management approach. Its ambitious "Build Better More" program is an example of the shift within government toward considering the entire asset lifecycle, from planning to decommissioning, rather than focusing solely on the initial investment. The country also adopted a national asset management policy in 2020, and established the National Asset Registry System (NARS), which stores more than 350,000 asset records and has the analytical capabilities to inform its disaster risk finance (DRF) and asset management efforts.

Results

- The DRFI strategy has mobilized the private sector through insurance, improving fiscal resilience and protecting more households and farmers, especially the most vulnerable. Over $500 million in premium subsidies from the national budget has also made agricultural insurance more affordable, resulting in an increase in insurance penetration to one-third of farmers.

- Payouts from several financial mechanisms have provided the government with funds to react to disaster-incurred damage. Triggered in 2022 by Typhoon Rai, the Catastrophe Bond paid out $52.5 million to the national budget and was used to finance the first NIIP for critical public assets. The government also disbursed its contingency credits with the World Bank Cat DDO, receiving $2 billion in budget support following disasters between 2011 and 2023. Finally, the parametric insurance program paid out around $28 million over two years.

- While payouts have played a crucial role in financing response and recovery efforts, embedding DRFI into government systems to enhance financial resilience and incorporating it into the budget process has been even more significant. Following the adoption of the national asset management policy in 2020, several line agencies have now established working groups that systematically look at asset lifecycles and are developing individual agency asset management plans. And since rolling out the NARS, which was essential for implementing the NIIP, the government has initiated the development of an annual disaster risk-based budgeting framework. This framework aims to make public financial systems more proactive in addressing disaster risks and ensuring that DRF instruments are integrated into annual budget planning and monitoring.

Key Takeaways

- Implementing a comprehensive risk-layering strategy takes time, and strong ownership is crucial for continuity. Consistently expanding its portfolio of DRFI solutions, the Philippine government met several challenges. For example, all stakeholders need to understand what role risk transfer instruments play and do not play. The parametric insurance payout process illustrates some of the challenges encountered, as cash payouts were successfully transferred to the national government but did not reach local governments due to a positive basis risk, a mismatch of policy objective and mechanism, government processes, and other issues.

- Working closely with legislative stakeholders is important, yet often overlooked. It is always difficult, but necessary, to justify budgeting for insurance premiums; and without understanding the principles or cost efficiencies of insurance, such proposals can face resistance. DRFI instruments can be extremely complex, in terms of both technical design and implementation, and it can take years to develop the policies and regulations necessary to establish a new DRFI tool or initiative.

- Engaging and harnessing the private sector will ensure DRFI instruments protect more people. It is impossible to address all disaster risk through public budget and development partner funding alone, and the Philippine government is exploring sustained ways to mobilize private sector finance. For example, it has invested a lot of resources in better protection for small and vulnerable farmers. Recognizing the limitations of tackling this solely through its own forces, the government is working to create a PPP between private insurers and the state insurer-the Philippine Crop Insurance Corporation-to leverage the latter's expertise and the private sector's operational efficiency and innovations to better protect Philippine farmers.

- Institutionalizing DRF will help ensure its sustainability and continuity. The Philippines is a country with a mature DRFI program, the Philippines has already started working on embedding disaster risk financing into-and implementing the DRFI strategy through-the government's budget cycle. This will ensure that DRFI becomes part of the day-to-day government business. DRF also cuts across sectors and agencies. As finance, budgeting, and treasury functions are separate, working across budget oversight agencies is key to good coordination in, and longevity of, disaster risk finance and management.