Request for proposal: Hiring of a consultant (individual or organization) on Nature-based Infrastructure Solutions to support Second Biennial Report

This job posting has closed

Background

The Coalition for Disaster Resilient Infrastructure (CDRI) is a multi-stakeholder global partnership of national governments, UN agencies and programmes, multilateral development banks and financing mechanisms, the private sector, and academic and knowledge institutions that aims to promote the resilience of new and existing infrastructure systems to climate and disaster risks in support of sustainable development. The vision, mission, goal, and objectives of CDRI are explicitly linked to the post-2015 development agendas. CDRI promotes its Disaster Resilient Infrastructure (DRI) mandate through knowledge exchange and bolstering technical capacities among member countries and partners through the following key Strategic Priorities:

- Advocacy and Partnerships

- Research, Knowledge Management and Capacity Building

- Program Support and Technical Assistance

In line with the Strategic Priorities around Research, Knowledge Management, and Capacity Building, CDRI launched its inaugural Biennial Report, titled "Global Infrastructure Resilience: Capturing the Resilience Dividend" in October 2023. The Biennial Report serves as CDRI’s principal vehicle for engaging and focusing the attention of global leaders, policymakers, practitioners, and researchers in addressing the critical and multifaceted challenges posed by disaster and climate-resilient infrastructure.

The First CDRI Biennial Report

The first edition of the Biennial Report is a significant milestone in CDRI’s ongoing effort to advance disaster and climate-resilient infrastructure globally. The Report addresses the unique challenges LMICs face. It outlines pathways for global resilience improvement, leveraging data from the first-ever fully probabilistic global risk assessment of infrastructure assets, known as the Global Infrastructure Risk Model & Resilience Index (GIRI). GIRI assesses the risk and resilience across nine major critical infrastructure assets covering seven hazards at a global level to arrive at financial metrics to prompt countries to formulate policies, plans, and strategies that incorporate resilience. Further, through rigorous data, evidence, and outputs, the Report underscores the idea of the “resilience dividend” that can support countries in transforming the perception of resilience from a cost to an opportunity, fostering financial incentives for resilience investments that benefit governments, investors, and communities alike.

The First Report outlines four critical dimensions for enhancing infrastructure resilience and capturing the resilience dividend, starting with improving infrastructure governance that involves enhanced planning, design standards, codes, regulations, compliance with Operations and Maintenance, and sharing of best practices to ensure the reliability and quality of infrastructure. The second dimension is investing in resilience by tapping private institutional capital (US$ 106 trillion worldwide) and innovative financial mechanisms. The report also highlights the need for knowledge sharing and capacity building on infrastructure resilience. Lastly, it explores the innovative use of nature-based infrastructure solutions to integrate natural systems in infrastructure design and operation strategies. The Biennial Report and its Executive Summary are now available for download at cdri.world/gir. The GIRI data platform, which facilitates visualization, interpretation, and analysis of data from the GIRI model, is accessible at cdri.world/giri.

Biennial Report: Second edition

CDRI now plans to publish the second edition of the Biennial Report by October 2025 (hereafter referred to as “the Report”). The Report will build on the comprehensive risk assessment methodology with global applicability developed for the first report. The Report aims to answer some of the questions raised during the preparation and dissemination of the first Report, expanding its remit and strengthening the connections between the risk analysis and the financial, institutional, and technological dimensions of resilient infrastructure.

The Report is organized along two main pillars. The first pillar is based on a series of modeling and analytical pieces that deepen, downscale, and project the results of the first Biennial Report into the future. The second pillar advances the work of the first Biennial Report from the “what is the resilience dividend” to the “how to capture the resilience dividend.”

Pillar 1: Deepening, Downscaling, Projecting the Report expands the work of the first report along three lines of work:

- Deepening the understanding of resilient infrastructure by (i) incorporating additional risks and updating the model with new databases; (ii) undertaking specific assessments of economic and poverty impacts due to infrastructure services failures caused by disasters; and (iii) completing global surveys to understand better the underlying factors of insufficient resilience and the impacts on businesses and the economy.

- Downscaling the global analysis undertaken for the first Biennial Report to the country and sub-national level to provide higher-quality risk assessments using better data and understanding of local conditions through national partners. At the same time, these analyses will review options, costs, and benefits of resilience and adaptation measures to reduce the impacts of disasters on infrastructure assets, systems, and services.

- Projecting the modeling exercise to incorporate future expected trends, including investment trajectories to achieve the infrastructure-related Sustainable Development Goals (SDG) targets, the projected growth of urban centers, and related areas of analysis.

Pillar 2: How to Capture the Resilience Dividend

The first Biennial Report provided a robust analysis of the magnitude of the “resilience dividend” at the global and national levels. The first report also took the first steps in analyzing ways in which more resilient and climate-adapted infrastructure can be built and maintained, including nature-based solutions and financial mechanisms. The Second Biennial Report will build on the foundation of the first report. It intends to move from the question of “What is the magnitude of the potential resilience dividend?” to “How can this resilience dividend be captured?” Under this Pillar, the Report will review: (i) financial instruments for resilience and adaptation; (ii) institutional, governance, and capacity frameworks; and (iii) frontier tools, including new technologies and nature-based solutions, among others. The First Biennial Report included a detailed chapter on Nature-based Infrastructure Solutions (NbIS). This chapter provided a solid overview of the definitions and rationale for using NbIS. In addition, it provided an overview of methodologies and some examples of NbIS.

The objective of the NbIS work in the Second Biennial Report is to move from the “why is NbIS important” to the “how” to design and implement NbIS at scale in infrastructure systems. The Second Biennial Report track on NbIS does not need to focus on the challenges of implementing these solutions. Rather, it should present approaches to overcome such challenges. The NbIS track of the Second Biennial Report should also analyze approaches and examples to move these solutions from the research and small pilot program scale to large-scale national approaches for infrastructure systems and services.

Common analytical framework across Biennial Report chapters

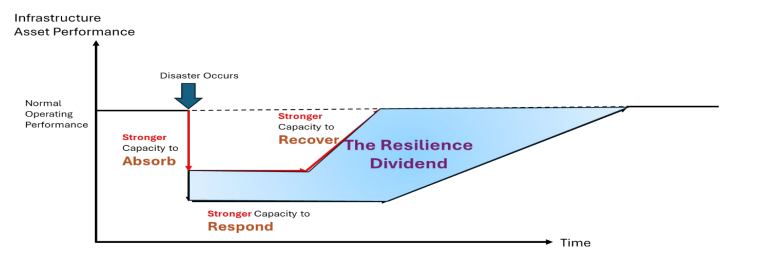

To ensure consistency across the background technical reports and the Biennial Report chapters derived from them, a common analytical framework has been developed, building on the approach used in the first Biennial Report. The operational disturbance of infrastructure assets due to disasters and the subsequent recovery can be described in three states or phases as shown in Figure 1: a degraded state, a recovery state, and a post-recovery state. The resilience of an infrastructure asset is not only related to its capacity to absorb shocks caused by disasters, but also the capacity of institutions to respond to the disaster and to recover from it. These three capacities: (i) to absorb; (ii) to respond to; and (iii) to recover from a disaster will be core to all chapters in the Biennial Report

Figure 1 – Three Core Capacities of Infrastructure Resilience

As countries strengthen their capacities to absorb, respond, and recover from disasters, they are able to capture the “resilience dividend,” shown in the shaded area of Figure 2.

Figure 2 – The Resilience Dividend

The Biennial Report will frame the analysis of the finance, institutional/ governance/capacity, technology, and nature-based solutions chapters in ways that directly help strengthen the capacities to absorb, respond to, and recover from disasters. Box 1 presents an initial list of questions that the NbIS track of the Biennial Report should answer regarding the three capacities of the analytical framework described. In analyzing the application of NbIS at scale, the consultant should review solutions that extend beyond the immediate vicinity of a specific infrastructure asset (for example basin-wide NbIS solutions linked to infrastructure networks, or even transboundary perspectives for specific cases).

Box 1 – Initial List of Questions for the NbIS Track of the Second Biennial Report Capacity to Absorb

Capacity to Respond and Recover

|

The Biennial Report chapters will be prepared in close coordination across authors. Specifically, the NbIS background report and chapter will need to incorporate coordinated inputs with:

- The institutional, governance, and capacity track, to ensure that the issues of institutional readiness to conduct upstream analyses, evaluate options, conduct integrated cost-benefit analysis, design maintenance strategies, acquire land for NbIS options, procure the installation and maintenance, and enhance the biodiversity values, are all considered. The experiences with capacity building of infrastructure agencies to use NbIS at scale will be described (specifically, the addition of biodiversity and NbIS experts or units in infrastructure agencies).

- The finance track, to explore financial mechanisms and instruments to support the use at scale of NbIS resilience options. This would include the financial mechanisms to pay for the maintenance and upkeep of the NbIS solutions by contractors and communities.

- The technology track, to explore ways in which new technologies (remote sensing, IoT, etc.) can enhance the resilience benefits of NbIS, aid in the capacity to absorb and recover from disasters, and support the biodiversity value enhancement of NbIS for resilient infrastructure.

Finally, the NbIS track of the Biennial Report should provide the following elements to answer the “how to” leverage technologies to capture the “resilience dividend”:

- Approaches for governments to mainstream NbIS solutions at scale in different infrastructure sectors

- Tools to: (i) identify the level of readiness to use NbIS to enhance the resilience of infrastructure services in different sectors; (ii) conduct gap analysis against global best practice; and (iii) identify priority institutional, policy, capacity, and technical changes to close the key gaps.

- Global examples and good practices of application of NbIS solutions at scale with specific reference to the areas described in these TORs.

- Roadmap to gradually enhance the use of NbIS to strengthen the resilience of infrastructure assets, networks, services, and users.

Objectives of the assignment

CDRI aims to onboard a Consultant for the NbIS Track, who, while working under the supervision of the Coordinating Lead Author and Senior Advisor to the Report, and in close coordination with the Report Project Management Unit (PMU) at CDRI, will be responsible for the financial aspects of the Report.

Specifically, the main objectives of this assignment are:

- To provide technical expertise, advice, authorship, and overarching support on the theme of NbIS for resilient infrastructure for the Report.

- To prepare a detailed background report and a summary chapter for the Report, as part of Pillar 2, focused on NbIS options at scale to strengthen the capacity of infrastructure assets, systems, and users to absorb, respond, and recover from disasters. The background report and summary chapter need to focus on “how to” capture the resilient infrastructure dividend from the NbIS perspective and provide practical “roadmaps” for countries to take steps to capture such dividend.

- To coordinate with the authors of the other chapters of Pillar 2 (institutions, finance, and new technologies) in a manner that ensures consistent messages across the different tracks and chapters.

The consultant is expected to ensure a timely delivery of all services for a smooth launch of the Report in October 2025.

Scope of work

The Consultant on NbIS will have the following responsibilities while working under the guidance of the Coordinating Lead Author and Senior Advisor on the second edition of the Biennial Report, and in close coordination with the Report’s PMU:

- Provide technical expertise in the area of NbIS for Resilient Infrastructure for all Report activities.

- Undertake a thorough and exhaustive literature review to bring the latest practices, policies, and innovations in NbIS for resilient infrastructure.

- Author a background report and a summary chapter for the Report focusing on NbIS for resilient infrastructure and in alignment with thematic focus and other chapters of the Report. This will entail the preparation of an annotated outline for review by CDRI.

- Collaboratively work with the Coalition member countries to identify good practices and country examples on the use of NbIS at scale for enhancing the resilience of infrastructure assets, networks, services, and users.

- Participate in meetings at designated intervals with the Coordinating Lead Author, Senior Advisor, PMU, and other consultants engaged in the report (both in person and remotely, with in-person meetings expected to take (3 to 4) working days over the period of assignment (plus travel time).

- Participate in dissemination and outreach activities for the Report.

- Prepare:

- An inception report

- An annotated outline of the background report

- Intermediate reports with (i) the proposed approach to country cases and good practices, (iii) a framework for the roadmap to strengthen the use of NbIS at scale for infrastructure resilience, and (iv) other small inputs as agreed with the Lead Author and Senior Advisor

- Draft and final versions of the background report and summary chapter

Deliverables

- Research/Inception Report: A detailed report outlining findings from research and analysis on cost-effective NbS, challenges, and integration of grey and green solutions.

- Intermediate Reports:

- Good Practices Document: A document detailing best practices for NbS recovery, methodologies for enhancing NbS design post-disaster, and avoiding malpractices.

- Toolkits and Case Studies: A collection of tools, methodologies, and global examples for evaluating and implementing NbIS solutions.

- Comprehensive Chapter: A complete chapter on Nature-Based Infrastructure Solutions for the Biennial Report, providing actionable insights and recommendations.

Duration

The consultancy is expected to last until October 2025, with specific milestones and deadlines to be agreed upon at the outset of the engagement to ensure the timely launch of the Report.

Reporting

The consultant will report to the Director of Research, Knowledge Management, and Capacity Building, and the Lead Specialist for the Biennial Report at CDRI. Regular updates on progress, challenges, and findings are expected.

Qualifications

- A minimum of 15 years of experience in nature-based solutions, ecological engineering, resilient infrastructure, and related fields. A minimum of a master’s degree in these disciplines is desired; a PhD is preferred.

- Proven experience in developing global reports and technical documents related to disaster resilience, NbIS, biodiversity, sustainable infrastructure and related fields.

- Excellent writing and communication skills in English.

- A proven track record of working with international organizations or in multicultural settings.

Proposal requirements

The proposal should be prepared in two parts - Technical and Financial. Both parts should be submitted as separate PDF files (password protected) attached in one email since the evaluation will be conducted through the QCBS method. Interested applicants should submit a Technical Proposal that includes the following:

- Curriculum Vitae: Outlining relevant academic and professional experience and expertise that demonstrates alignment to the key objectives, scope of work, key competencies, and the overarching thematic focus of Financing for Resilient Infrastructure.

- Technical Approach & Workplan: A detailed description of the proposed approach and workplan for the outlined deliverables for both assignments, based on the respective key objectives and scope of work.

- Timeline: An estimated timeline for outlined deliverables for both assignments, based on the respective key objectives and scope of work.

The proposal must be sent to the email address [email protected] with the subject line: "CDRI Second Biennial Report Consultant on NbIS" and received by CDRI on or before 20 November 2024 by 11:59 PM IST which stands to be the deadline for the proposal submission. Any proposal received by CDRI after the deadline for submission shall not be opened.

Financial Proposal: Applicants shall quote an all-inclusive lump sum price based on their per-day consultancy charges. This proposal must cover all aspects mentioned in the scope of work for both assignments. All payments shall be subject to tax deduction at source per the tax laws of India.

The Password for the Technical proposal pdf file is to be submitted on the same email id by 1200 hours (IST) one (1) day after the final proposal submission date. Times New Roman Font to be used for Password to ensure readability.

The password of the financial proposal shall be requested after the evaluation of the technical proposal. Date and time of sending the password shall be intimated accordingly. Sharing passwords for Financial Bid along with the bids may lead to its rejection and the failure to comply with any of the modalities mentioned here will result in cancellation of the proposal.

Selection criteria

The consultant will be selected following a Quality Cum Cost Basis (QCBS) of selection, and form of contract would be Lump-sum Performance Based Contract. Proposals shall be evaluated as follows: Evaluation Criteria for Technical Bids 100 points:

| S N | Technical evaluation criteria | Maximum marks |

|---|---|---|

| 1 | Academic qualification | 15 |

| 2 | Professional work experience | 20 |

| 3 | Experience of working on reports/strategic documents of a global scale | 20 |

| 4 | Technical approach and workplan for the assignment | 30 |

| 5 | Experience of working with International Organization(s) or in a multicultural setting. | 15 |

| Maximum marks | 100 | |

| Rating multiplier for Methodology, Approach | |

|---|---|

| Level of Responsiveness | Rating |

| Irrelevant | 0% |

| Poor | 25% |

| Satisfactory | 50% |

| Good | 75% |

| Excellent | 100% |

The applicant scoring more than 70% in the technical evaluation shall be considered for financial evaluation. 80% weightage will be awarded for the Technical Proposal and 20% weightage will be awarded for Financial Proposal. Technical Bid will be assigned a Technical score (Ts) out of a maximum of 100 points.

The Agency’s Financial Scores (Fn) are normalized as per the formula below:

Fn = Fmin/Fb * 100 (rounded off to 4 decimal places) Where,

Fn = Normalized commercial score for the Agency under consideration

Fb = Absolute financial quote for the Agency under consideration

Fmin = Minimum absolute financial quote

Formula for final evaluation:

Composite Score (S) = Ts * 0.80 + Fn * 0.20

The agency with the highest Composite Score (S) would be considered for the award of the contract and will be called for negotiations if required.

Terms of payment

This would be a lump-sum contract with the following payment schedule. (Payments will be made upon approval of the submissions/deliverables by competent authorities at CDRI.

| S. No. | Deliverables across 12 months beginning from the date of onboarding | Payment |

|---|---|---|

| 1 | Research/Inception Report: A detailed report outlining findings from research and analysis on cost-effective NbS, challenges, and integration of grey and green solutions. | 30% |

| 2 | Intermediate Reports:

| 50% |

| 3 | Comprehensive Chapter: A complete chapter on Nature-Based Infrastructure Solutions for the Biennial Report, providing actionable insights and recommendations. | 20% |

Standards of quality

Information and data created according to the Scope of Work should follow internationally accepted standards and practices.

Reporting structure

The Consultant will work in close coordination with the Coordinating Lead Author for the Report and report to the Director (RKM&CD) and Lead Specialist – Biennial Report providing regular updates on progress, challenges, and key decisions.

Other terms & conditions

- The proposals should be valid for 90 days after the final submission date.

- CDRI reserves the right to cancel this Request for proposal before or after the receipt of proposals or after opening the proposal and call for fresh proposals. CDRI also has the right to reject any proposal without assigning any reason.

- Proposals incomplete in any respect will not be considered.

- Please note that the consultant must clearly disclose the contractual and payment terms in its proposal.

The consultants are requested to submit their proposal through email to [email protected] by 23:59 hrs (IST) on 20 November 2024. Responses received after the stipulated time or not in accordance will be summarily rejected.

Please ensure that your proposal is sent ONLY to ABOVE MENTIONED email ID before the closing date & time. Proposals sent/copied to any other email ID (other than above) OR received after the bid closing date & time (mentioned above) will not be entertained.