RFP: Hiring an organization for conducting Macroeconomic Modelling to support the Second CDRI Report on Global Infrastructure Resilience

Background

The Coalition for Disaster Resilient Infrastructure (CDRI) is a multi-stakeholder global partnership of national governments, UN agencies and programmes, multilateral development banks and financing mechanisms, the private sector, and academic and knowledge institutions. It aims to address the challenges of building resilience into infrastructure systems and the development associated with it. The vision, mission, goal, and objectives of CDRI are explicitly linked to the post-2015 development agendas.

CDRI launched its inaugural Biennial Report on Global Infrastructure Resilience: Capturing the Resilience Dividend in October 2023. The Biennial Report is CDRI’s principal vehicle for engaging and focusing the attention of a global audience of political leaders, policymakers, practitioners, and researchers on the critical and multifaceted challenges posed by disasters and climate change on infrastructure assets, systems, and services. The Report builds the evidence for prioritizing investments to bolster infrastructure resilience globally, particularly by aiding Coalition members through knowledge sharing, capacity building, and exchange of best practices. Moving forward, CDRI aims to publish the Second Biennial Report by 2025. The Second Biennial Report will leverage the key findings and lessons from the inaugural edition to strengthen the analysis further and address some of the questions posed by the Report towards capturing the resilience dividend.

The First CDRI Report

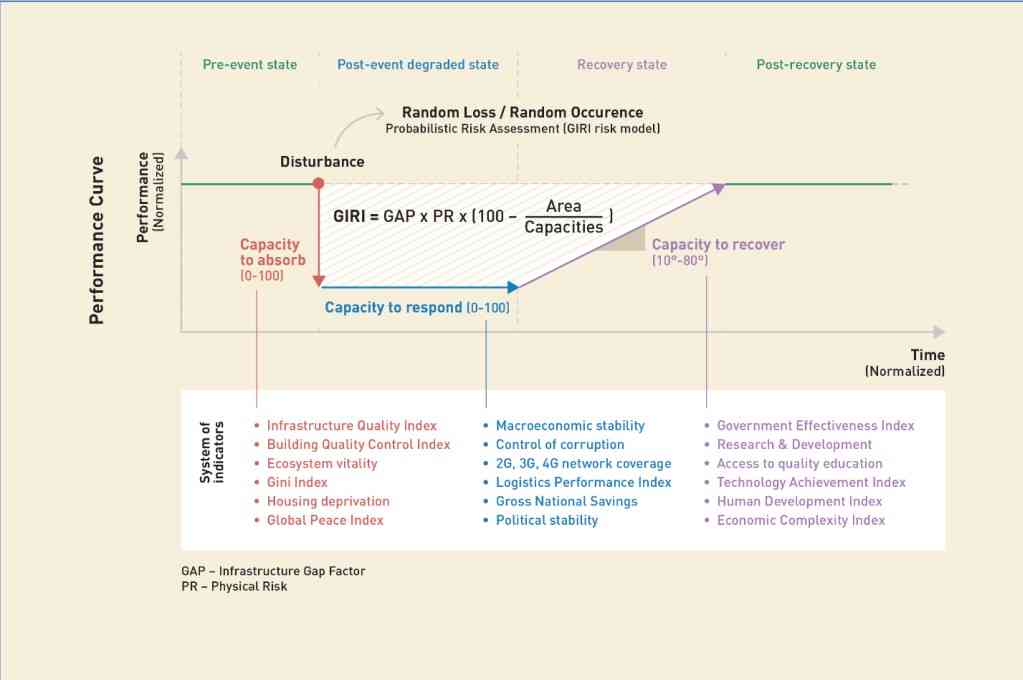

The first edition of the Biennial Report is a significant milestone in CDRI’s ongoing effort to advance disaster and climate-resilient infrastructure globally. The report addresses the unique challenges Low-and-Middle Income Countries (LMICs) face. It outlines pathways for global resilience improvement, leveraging data from the first-ever fully probabilistic global risk assessment of infrastructure assets, known as the Global Infrastructure Risk Model & Resilience Index (GIRI).

GIRI assesses the risk and resilience across nine major critical infrastructure assets covering seven hazards at a global level to arrive at financial metrics that instigate countries to formulate policies, plans, and strategies that incorporate resilience. Further, through rigorous data, evidence, and outputs, the report underscores the idea of the “resilience dividend” that can support countries in transforming the perception of resilience from a cost to an opportunity, fostering financial incentives for resilience investments that benefit governments, investors, and communities alike.

Apart from GIRI, the first Report also outlines four critical dimensions for enhancing infrastructure resilience and capturing the resilience dividend, starting with improving infrastructure governance that involves enhanced planning, design standards, codes, regulations, compliance with Operations and Maintenance, and best practices exchange to ensure the reliability and quality of infrastructure. The third dimension is investing in resilience through attracting untapped private institutional capital (US$ 106 trillion worldwide) and innovative financial mechanisms. The report also highlights the need for knowledge sharing and capacity building on infrastructure resilience. Lastly, it explores the innovative use of nature-based infrastructure solutions to integrate natural systems in infrastructure design and operation strategies.

The report, along with its executive summary, is available for download at: cdri.world/gir. The GIRI data platform is also an integral part of the Biennial Report and makes available the data from the GIRI model for visualization, interpretation, and analysis. It can be accessed at: cdri.world/giri.

The Second CDRI Report

The Second CDRI Biennial Report builds on the comprehensive risk assessment methodology with global applicability developed for the first report. The Second Report aims to answer some of the questions raised during the preparation and dissemination of the first Report, expanding its remit and strengthening the connections between the risk analysis and the financial, institutional, and technological dimensions of resilient infrastructure. CDRI intends to have strong linkages between the various lines of work of the Second Report and the rest of the organization to ensure that the latest practical results and field experiences of CDRI teams are reflected in the Biennial Report and, vice versa, the methodologies and frontier thinking of the Report is incorporated in the work program of the Coalition.

The Second CDRI Biennial Report is organized along two main pillars. The first pillar is based on a series of modelling and analytical pieces that deepen, downscale, and project the results of the first Biennial Report into the future. The second pillar advances the work of the first Biennial Report from the “what” to the “how.”

Pillar 1: Deepening, Downscaling, Projecting

The Second CDRI Biennial Report expands the work of the first report along three lines of work:

Deepening the understanding of resilient infrastructure by (i) incorporating additional risks and updating the model with new databases; (ii) undertaking specific assessments of economic and poverty impacts due to infrastructure services failures caused by disasters, including a perspective on small and community infrastructure; and (iii) completing global surveys to understand better the underlying factors of insufficient resilience and the impacts on businesses and the economy.

Downscaling the global analysis undertaken for the first Biennial Report to the country and sub-national level to provide higher-quality risk assessments using better data and understanding of local conditions through national partners. At the same time, these analyses will review options, costs, and benefits of resilience and adaptation measures to reduce the impacts of disasters on infrastructure assets, systems, and services.

Projecting the modelling exercise to incorporate future expected trends, including investment trajectories to achieve the infrastructure-related Sustainable Development Goals (SDG) targets (with special attention to the vulnerabilities of last mile infrastructure services), the projected growth of urban centres, and related areas of analysis.

Pillar 2: How to Capture the Resilience Dividend

The first Biennial Report provided a robust analysis of the magnitude of the “resilience dividend” at the global and national levels. It also took the first steps in analysing ways to build and maintain more resilient and climate-adapted infrastructure, including nature-based solutions and financial mechanisms. The Second Biennial Report will build on the foundation of the first report. It intends to move from the question of “What is the magnitude of the potential resilience dividend?” to “How can this resilience dividend be captured?”

Under this Pillar, the Second Biennial Report will review (i) financial instruments for resilience and adaptation, (ii) institutional, governance, and capacity frameworks, and (iii) frontier tools, including disruptive technologies and nature-based solutions, among others.

The report will present frameworks for each work area, building on the best approaches developed by other organizations, documenting good practices, and creating roadmaps for action. The “how to” discussions in Pillar 2 will be structured around and closely linked to the framework used in the first Biennial Report, which is based on countries' capacities to absorb a disturbance to the infrastructure asset caused by a disaster, respond to the disaster, and recover to the original performance (or even to build back better).

These capacities depend on various capacities, mechanisms, institutions, regulations, and overall governance of the infrastructure systems and services. Pillar 2 will explore how to strengthen each of these capacities through enhanced financial mechanisms, institutional, governance, and capacity characteristics, as well as innovative solutions. Pillars 1 and 2 of the Report are closely connected in practice, as the modelling results and insights developed in Pillar 1 are indispensable to define roadmaps for action to capture the resilience dividend as analysed in Pillar 2.

Finance: Pillar 2 of the Second Biennial Report will present practical approaches to financing infrastructure assets and systems with greater capacity to absorb disturbances caused by disasters. These include financing more resilient and better climate-adapted infrastructure and proactive disaster-focused enhanced maintenance of the assets. The report will also review experiences and best practices with financial mechanisms allowing faster and more efficient post-disaster response and recovery. These include insurance, credit lines, catastrophic bonds, and other tools. The financing of maintenance, aging infrastructure upgrades, and nature-based solutions, among others, will be explored. The institutional arrangements, capacities, and roadmaps to develop and continuously improve these financial mechanisms will also be discussed, including the role of significant stakeholders such as the financial regulators and the insurance sector. Business models to mobilize private capital for resilient infrastructure will be explored. Finally, the analysis will explore ways to quantify and monetize the resilience dividend across public and private stakeholders.

Institutions and governance: The capacities to absorb, respond, and recover depend on the institutions, governance arrangements, and capacities of government agencies, infrastructure users, and the infrastructure construction, maintenance, and operations ecosystem (with its many public and private stakeholders and sometimes uncoordinated and overlapping responsibilities). The differential capacities of the national and local governments will be part of the analysis, as well as the diverse governance mechanisms and systems for resilient infrastructure. Pillar 2 of the Report will review the best approaches and frameworks of analysis, present good practices worldwide, and propose roadmaps to strengthen institutions and governance for resilient infrastructure. The institutions and stakeholders to be analysed are not limited to the infrastructure agencies but will encompass many other related government agencies, the private sector (from designers to contractors, construction supervisors, and operators), and users.

Tools and technologies: The Second Biennial Report will conduct a deep dive into new tools and technologies currently under development, testing, and initial stages of scaling up. The analysis will go beyond listing these tools and technologies and focus on the “how to” identify, prioritize, select, finance, implement, and upgrade these tools and technologies. Pillar 2 will focus on disruptive and information technologies for resilience (from artificial intelligence to remote sensing, advanced sensors and materials, machine learning, and cybersecurity) and nature-based solutions. The review will take a cautious approach to applying these technologies in countries with diverse capacities and avoid the perception that new tools and technologies alone can help governments and users capture the resilience dividend. Furthermore, the Report will have a balanced analysis to illustrate the need to combine NBS with gray infrastructure and the difficult trade-offs involved in design and implementation.

Each of these work areas will develop:

- Approaches for governments to continuously scan the horizon, understand, and leverage new technologies

- Tools to work with the private sector to develop, test, and scale up use of disruptive technologies to enhance the resilience of infrastructure assets and networks

- Global examples and good practices of technologies to capture the resilience dividend

Risk Modelling in First CDRI Report - GIRI

- GIRI helps in identifying and estimating the risk associated with major geological and climate-related hazards (Earthquake, Tsunami, Landslide, Flood, Tropical Cyclone and Drought) across critical infrastructure sectors (Power, Telecommunications, Roads and Railways, Water and Wastewater, Ports and Airports, Oil and gas, Buildings, Education and Health) for all countries and territories in the world and considering climate change.

- Its purpose is to improve the understanding and make the global landscape of infrastructure risk and resilience visible. In doing so, GIRI provides a globally comparable set of financial risk metrics such as the Average Annual Loss (AAL) and Probable Maximum Loss (PML) for infrastructure assets.

- GIRI can assist in the identification of the contingent liabilities internalized in each infrastructure sector and the implications for social and economic development in the context of climate change. It can, thus, provide the basis for developing national resilience policies, strategies and plans, resilience standards, and for correctly integrating disaster and climate risk into investment decisions.

- The Model estimates financial risk metrics such as the AAL, estimating the contingent liabilities associated with infrastructure assets in each sector and geography, with respect to each hazard. The Index integrates the financial risk metrics from the Model with three different sets of indicators that represent the capacity of a country to resist and absorb, respond, and restore or recover from hazard events. Additionally, the Index considers the infrastructure gap, defined as the difference between the infrastructure required to meet the SDGs and the existing infrastructure.

Objectives of the assignment

Building on the estimation of direct economic loss and damage to infrastructure assets under GIRI 1.0, CDRI aims to hire an organization (consortiums are allowed) to estimate indirect losses and wider macroeconomic impacts of damage to infrastructure systems due to disasters and climate change. The main objective of the assignment is to assess the multi-dimensional impact of the current levels of infrastructure resilience on economies, especially LMICs and Small Island Development States (SIDS), to feed into the Second CDRI Report on Global Infrastructure Resilience.

Specifically, the objectives of the assignment include conducting the following for five countries:

- Macroeconomic modelling analysing the economic impact of damage to infrastructure systems and services under business as usual (BAU) and different future climate scenarios. Economic impacts are to be quantified for indicators including but not limited to GDP, employment, income, and others, as proposed by the organization.

- Assessment of risks considering damage to infrastructure assets and disruption of services caused by hazards analyzed in GIRI 1.0, including:

- Damages to thermal and renewable power generation assets as well as the transmission network due to wind, cyclones, floods, and landslides;

- Damages to the total road network due to floods, landslides, and earthquakes;

- Damages to buildings due to cyclones, floods, and earthquakes.

- Disaggregated model results (impacts on economy) by infrastructure sector and type of hazard.

Scope of work

The organization is expected to use macroeconomic models such as the Green Economy Model (GEM) to assess damage to economic flows and wider impacts due to failure of infrastructure assets and disruption of services under BAU and various climate change scenarios.

The assignment will also consider the results from the GIRI 1.0 model for current and future hazards. GIRI 1.0 provides hazard, exposure, and vulnerability data, including financial risk metrics in the form of AAL, PML, and LEC as outlined in Section 4.

The organization will have the following responsibilities while working under the guidance of the Coordinating Lead Author for the Second CDRI Report:

- Selection of countries: The organization will propose five countries for the assignment that are diverse in terms of region and size (from SIDS to mid-size countries) and levels of infrastructure asset development (low-income and middle-income), and have good data availability to model the linkages of infrastructure failures and macroeconomic sectors. Country selection criteria to be specified in the proposal, with further explanation to be provided in the Inception Report.

- Model Calibration: This would involve collecting data at the country level, including historical economic data (e.g., GDP, employment, income, infrastructure metrics, etc.) and climate-related data, macroeconomic model parametrization, simulation, and validation of the baseline scenario for a fully operational model ready to simulate country scenarios. Clear documentation of the calibration process, assumptions, data sources, and any limitations of the model should be provided in the proposal.

- Scenario Analysis: simulation of the model for BAU and various climate change scenarios, namely Shared Socioeconomic Pathway (SSPs), under different warming projections. Outputs will include model simulation results, including spreadsheets with key outputs and graphs.

- Reporting: This task involves synthesizing the findings from the scenario analysis into a comprehensive and accessible report, as well as the preparation of country PPTs. Specifically, the following deliverables are expected:

- PowerPoint presentation and full set of results in Excel for each country analyzed.

- Technical Report including model documentation, summarizing the main characteristics of the Green Economy Model (GEM).

- Summary Report for the Second CDRI Report including key messages, information on the model and underlying methodology, scenario assumptions, presentation of results (overall, by country and across countries), and their interpretation.

- Exchanges with the CDRI Team: Frequent collaboration with the CDRI Report Drafting team is essential. Regular exchanges will facilitate feedback, clarification, and integration of additional insights from other work streams. The organization is expected to participate in meetings at designated intervals with the Coordinating Lead Author, the Core Team at the CDRI Secretariat, and other consultants engaged for the Second CDRI Report.

- Dissemination: The organization will prepare dissemination materials and participate in the dissemination activities of the Second CDRI Report on a need basis.

Timeframe

The project is expected to last until January 2026, with specific milestones and deliverables due by July 2025 to ensure the timely launch of the Second CDRI Report. A detailed work plan and schedule of deliverables must be included as part of the Technical Proposal.

For specific timelines for each milestone/deliverable, please refer to Section 8, "Schedule of Deliverables."

Schedule of deliverables

| S N | Timeline | Milestone/deliverable | Details |

|---|---|---|---|

| 1 | 2 weeks after the assignment award | Inception report | Submit a detailed work plan (activities, timing, methodology, data sources, selected countries) for approval by the Coordinating Lead Author and CDRI Report Team. The deadlines for each task will be finalized in the work plan based on discussion and approval of the CDRI team. |

| 2 | 4 weeks after the assignment award | Model Calibration | Fully operational model, with validated current country scenarios for all 5 countries |

| 3 | 8 weeks after the assignment award | Scenario Analysis and Country PPTs | Model simulation, including Excel files and county PPTs with key outputs and graphs. |

| 4 | 15 July 2025 | Technical Report and Draft Summary for Second CDRI Report | Model documentation, summarizing the main characteristics of the Green Economy Model (GEM) to go as a Background Report on CDRI website |

| 5 | 31 July 2025 | Final Summary for Second CDRI Report | Key messages, information on the model and underlying methodology, scenario assumptions, presentation of results (overall, by country and across countries), and their interpretation. CDRI will be responsible for the copyediting, design, and printing. |

| 6 | January 2026 | Outreach and dissemination tasks | In consultation with CDRI |

In addition to the above deliverables, the organization will provide periodic work progress updates to the Coordinating Lead Author and CDRI Team through regular meetings/ emails at a mutually agreed frequency.

Note: All data (including but not limited to base data used, simulation results, and final map layers) should be shared with CDRI in an open data format along with appropriate metadata and technical documents detailing the approach and methodology.

Reporting

The organization will work in close coordination with the Coordinating Lead Author for the Report and report to the Director (RKM&CD) and Lead Specialist – Biennial Report, providing regular updates on progress, challenges, and key decisions.

Key competencies

Towards describing the expertise of the bidder, the proposal should clearly highlight the following:

- The year and state/country of incorporation and a brief description of the bidder’s present activities.

- National and international experience, including working with international networks and organizations.

- Experience in similar and relevant projects and previous relevant UN projects / similar or equivalent organizations (evidenced by sharing the experience of working on similar projects).

- Familiarity with internationally used concepts, tools, and practices in macroeconomic modelling.

Clarifications by bidders

- Bidders requiring any clarification on the RFP document may contact the Procurement Unit of CDRI in writing as per the format attached at ‘Annexure-I’ by email to [email protected]

- CDRI shall endeavor to respond to the queries raised or clarifications sought by the bidders. However, CDRI reserves the right not to respond to any query or provide any clarification, in its sole discretion, and nothing in this clause shall be construed, taken, or read as compelling or requiring CDRI to respond to any query or to provide any clarification.

- At any time prior to the proposal due date, CDRI may, for any reason, whether at its own initiative or in response to clarifications requested by the bidder(s), modify the RFP document by way of issue of Addendum/ Corrigendum/ Clarifications. Any Addendum/ Corrigendum/ Clarifications thus issued shall be shared with all bidders by email and/or uploaded on the website of CDRI (https://app.cdri.world/tender/) and shall be binding on bidders and shall form part of the RFP document.

Evaluation

- The organization will be selected following a Quality Cum Cost Basis (QCBS) of selection.

- Proposals shall be evaluated as follows: Evaluation Criteria for Technical Bids 100 points:

| S N | Technical Evaluation Criteria | Total points |

|---|---|---|

| A | Bidder’s qualification, capacity, and relevant experience | 50 |

| 1 | Expertise and experience of the Service Provider in Macroeconomic Modelling at the country or global level. Minimum of 15 years of experience in the domain of system dynamics, macroeconomic modelling, including application of GEM: 10 points for every additional two years of experience: 2 points each up to a maximum of 20 points Documents required: Bidders are required to submit evidence (details/documents) in support of compliance with the above criteria | 20 |

| 2 | Completed/ ongoing Contracts in Macroeconomic Modelling A minimum of one (1) contract completed in the last 5 years = 7 points For every additional contract = 2 points up to a maximum of 15 points. Documents required: Copies of relevant contracts/ work orders and completion certificate as proof of experience in the required areas | 15 |

| 3 | Completed/ ongoing Contracts o n application of Global Economy Model (GEM) at the country level A minimum of one (1) contract completed in the last 5 years = 7 points For every additional contract = 2 points up to a maximum of 15 points. Documents required: Copies of relevant contracts/ work orders and completion certificate as proof of experience in the required areas. | 15 |

| B | Proposed Work Plan for each component, including allocation of responsibilities. The Methodology and its responsiveness to the Terms of Reference shall be the primary evaluation criteria | 50 |

| 1 | Work allocation between the Proposed Team based on their respective experiences and capacities. (The bidder will provide a detailed allocation of man-days among the proposed team based on individual expertise and the attributable responsibilities for each component.) SCORING - Excellent: 10; Very Good: 7; Good: 5; Satisfactory: 3; Poor: 1; irrelevant: 0 | 10 |

| 2 | Relevance and detailing of the Methodology and Work Plan SCORING – Excellent: 40; Very Good: 35; Good: 30; Satisfactory: 20; Poor: 10; irrelevant: 0 | 40 |

| Total points obtainable (A + B) | 100 | |

| Rating multiplier | |

|---|---|

| Level of responsiveness | Rating |

| Irrelevant | 0% |

| Poor | 25% |

| Satisfactory | 50% |

| Good | 75% |

| Very Good | 90% |

| Excellent | 100% |

The applicant scoring equal to or more than 70% in the technical evaluation shall be considered for financial evaluation. 80% weightage will be awarded for the Technical Proposal, and 20% weightage will be awarded for the Financial Proposal. Technical Bid will be assigned a technical score (Ts) out of a maximum of 100 points.

The organization’s Financial Scores (Fn) are normalized as per the formula below:

Fn = Fmin/Fb * 100 (rounded off to 4 decimal places) Where,

Fn = Normalized commercial score for the organization under consideration

Fb = Absolute financial quote for the organization under consideration

Fmin = Minimum absolute financial quote formula for final evaluation:

Composite Score (S) = Ts * 0.80 + Fn * 0.20

The organization with the highest Composite Score (S) would be considered for the award of the contract and will be called for negotiations if required.

Terms of payment

The lump sum contract is structured to include deliverable-based payments. Payments are tied to specific deliverables, with allocation of different percentages based on the completion and approval of these deliverables by the competent authorities at CDRI. The breakdown of payments and the associated deliverables is outlined in the table below.

| S. N. | Linked Deliverables Payment | Percentage |

|---|---|---|

| 1 | i. Inception Report ii. Model Calibration iii. Scenario Analysis and Country PPTs | 40% |

| 2 | iv. Technical Report v. Summary for Second CDRI Report (draft and final) | 40% |

| 3 | vi. Outreach and dissemination tasks | 20% |

Standards of quality

Information and data created according to the RFP should follow internationally accepted standards and practices.

Proposal Submission

Please share proposals in two separate PDF files:

- Technical Proposal (Open PDF file)

- Financial Proposal (Password-Protected PDF File)

Note: The Financial Proposal PDF must be password-protected. Under no circumstances should the password be shared at the time of submission. It will be requested separately after the RFP submission deadline has passed.

The proposal must be sent to the email address [email protected] with the subject line: "Proposal-Macroeconomic Modelling-Second CDRI Report on Global Infrastructure Resilience”

Interested bidders are requested to submit their proposal by 23:59 hrs (IST) on 21 April 2025. Responses received after the stipulated time or not in accordance will be summarily rejected.

Please ensure that your proposal is sent ONLY to the ABOVE-MENTIONED email ID before the closing date & time. Proposals sent/copied to any other email ID (other than above) OR received after the bid closing date & time (mentioned above) will not be entertained.

Other terms & conditions

- The proposals should be valid for 90 days after the final submission date.

- An Association/ Joint Venture/ Consortium is allowed. Bidders participating as a consortium must submit a consortium agreement clearly defining the lead agency along with roles, responsibilities, and obligations of each member. The association of Agencies shall be evaluated as a single entity as per the qualification/ eligibility criteria outlined in the RFP. If any member of the Association of Agencies is dropped during or at any time after the RFP stage, such an association of the Agency is liable to be rejected by CDRI or lead to the termination of the contract.

- CDRI reserves the right to cancel this Request for proposal before or after the receipt of proposals or after opening the proposal and call for fresh proposals. CDRI also has the right to reject any proposal without assigning any reason.

- Proposals incomplete in any respect will not be considered.

The downscaling work will continuously look at opportunities to validate the model results against actual damage data at the regional or country level and emphasize the need for countries to strengthen their data collection and post-disaster forensic analysis for later use in improving the probabilistic risk assessment model.

Procurement was highlighted as a critical area of analysis for the institutions and governance workstream of the Report in the consultations.

This analysis will consider local conditions and will highlight the need to bring together solid engineering, ecological, and cost-benefit analyses.