|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

|

|

186 Part III - Chapter 11

11.2

Emerging practices

Global businesses have risk management strategies for their own assets and operations in place. Owing to recent experience, a number are now demanding risk assessments along their supply chain. But only a few are beginning to take the lead on a broader approach to disaster risk.

New perspectives on business risk management are emerging, however. In the case of global corporations, additional consultations carried out for this report indicate a gradual shift in perspective. As Box 11.3 highlights, large global businesses are starting to move from a narrow focus on business continuity planning towards a broader approach to prospectively manage their disaster risks. However, these changes are still incipient and are only reflected in more recent (three-to-four year) risk management policies.

This gradual widening of focus from business continuity planning to a more comprehensive and strategic approach to disaster risk management mirrors developments in the public sector where central planning and finance ministries begin to assess disaster risks and integrate disaster risk considerations into national planning and accounting processes (UNISDR, 2011

UNISDR. 2011.,Global Assessment Report on Disaster Risk Reduction: Revealing Risk, Redefining Development., United Nations International Strategy for Disaster Reduction., Geneva,Switzerland: UNISDR.. . gagement to agree on policies, strategies and plans to manage disaster risks or to develop appropriate risk governance arrangements.

In addition, where corporations have a global remit, their incentives to engage with local or national regulators and actors may be limited. Through diversifying their supply chains in different industry sectors they may, on the one hand, increase their vulnerability to disaster risks in specific locations; on the other hand, they may spread their risks and increase their room to manoeuvre in times of crises or when facing tough regulations in particular locations.

A number of large global businesses are now demanding risk assessments from small businesses that are key suppliers. A few companies have successfully combined enhanced information of potential disruptions, supply chain and financial impact with simulations of disaster events to reach a more comprehensive understanding of risk drivers and geographical concentration of risk as a basis for their supply chain management (Box 11.4).

But disaster risk management has also been recognised as a business development opportunity, particularly because of long-term climate change. A recent study of SMEs in Germany shows that the range of products and tools for risk management—particularly in flood management, which businesses already market—is significant and has the potential to

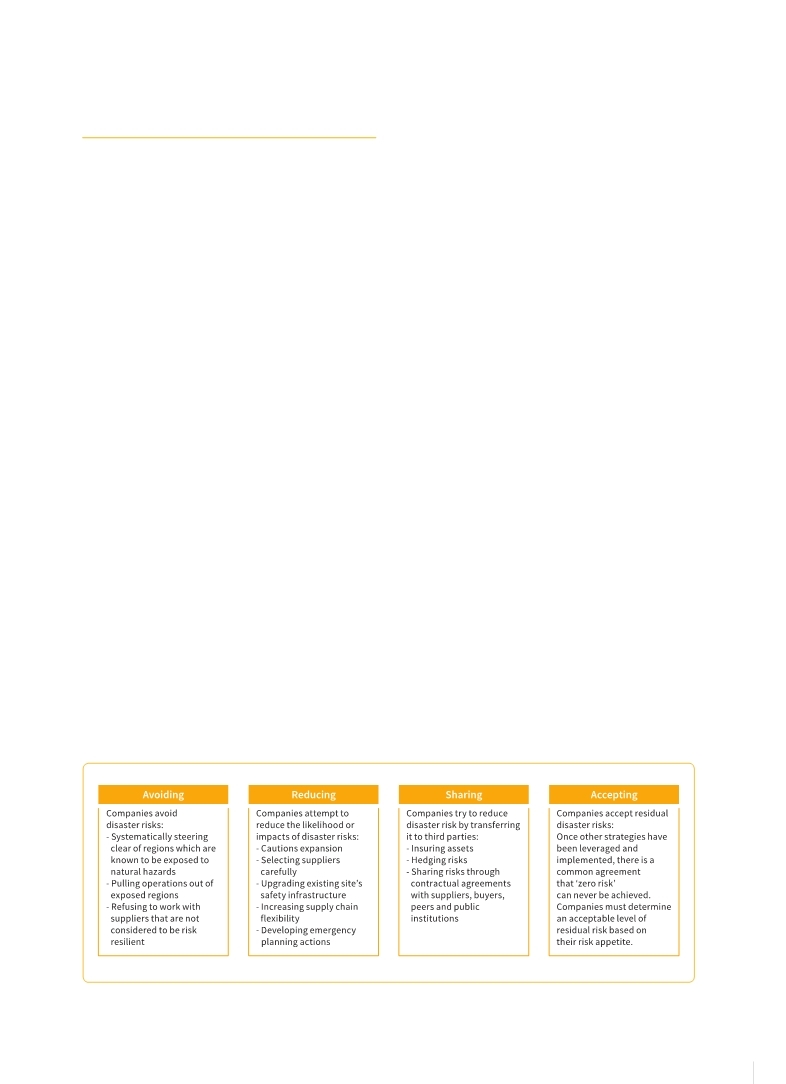

Figure 11.3 Company risk management strategies

(Source:

PwC, 2013 PwC, 2013 PwC (PricewaterhouseCoopers). 2013.,UNISDR and PwC – Working together to reduce disaster risks., Report prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. PwC (PricewaterhouseCoopers). 2013.,UNISDR and PwC – Working together to reduce disaster risks., Report prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. |

|