|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

|

|

193

(IPCC, 2012

IPCC (Intergovernmental Panel on Climate Change). 2012.,Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation., Special Report of Working Groups I and II of the Intergovernemental Panel on Climate Change (Field, C.B., V.Barros, T.F.Stocker, D.Qin, D.J.Dken, K.L.Ebi, M.D. Mastrandrea, K.J. Mach, G.-K. Plattner, S.K. Allen, M. Tignor, and P.M. Midgley (eds.). Cambrid, Cambridge, UK, and New York, NY, USA.,. . 12.2

Hidden risks in the

institutional investment

value chain

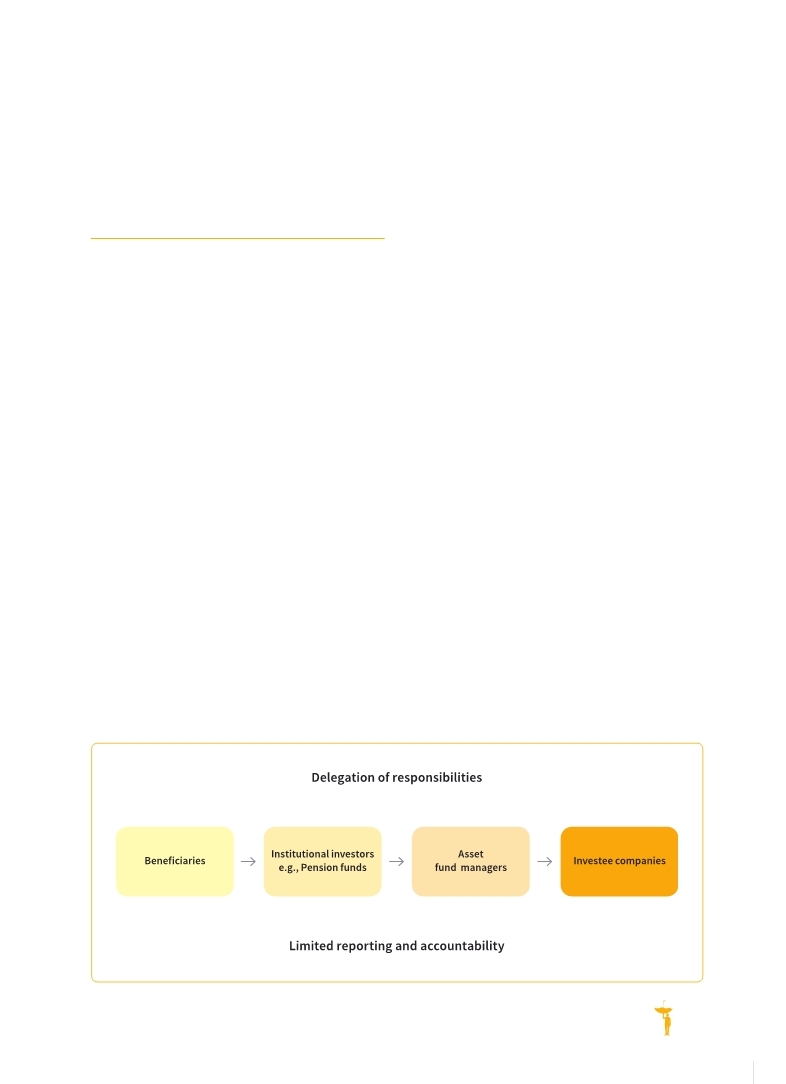

Investors and their fund managers are far removed from the consequences of the investment decisions they take, all but erasing effective accountability. In addition, the increasing complexity of investment products and trading systems has resulted in an opaque system that creates hidden risks, including disaster risk.

The institutional investment value chain includes institutional investors such as pension funds, mutual funds, sovereign wealth funds, hedge funds, insurance funds and private equity; and intermediaries, such as investment banks, asset managers and investment consultants (Cambridge Programme for Sustainable Leadership, 2011a

Cambridge Programme for Sustainable Leadership. 2011a.,Increasing mainstream investor understanding of natural capital. Part A: Main Report., The Cambridge Natural Capital Programme. University of Cambridge., Cambridge,UK.. . Institutional investors manage assets worth more than US$80 trillion globally (Ibid.) on behalf of hundreds of millions of beneficiaries such as employees, in the case of pension funds; national citizens, in the case of sovereign wealth funds; premium holders, in the case of insurance funds; and rich in-

dividuals, in the case of foundation-based or high net worth wealth managers (

Clements-Hunt, 2012 Clements-Hunt, 2012 Clements-Hunt, P. 2012.,Investment, Finance and Capital Market Perspectives. The Blended Capital Group., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Clements-Hunt, P. 2012.,Investment, Finance and Capital Market Perspectives. The Blended Capital Group., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. Although intermediaries ultimately have a fiduciary responsibility vis-à-vis original investors (beneficiaries), their primary role is to identify investment opportunities that benefit from a certain level of risk and return. These investments are made across a range of financial instruments, including the trading of stocks and bonds. In particular, trading activity in so-called over-the-counter (OTC) markets significantly outweighs turnover on closely regulated and more transparent public stock markets (ClementsHunt, 2012).

Asset managers rarely consider disaster risk when making investments. The increasing distance between these managers and beneficiaries means that the latter are increasingly disconnected from how their investment portfolios are being managed, including how much is at risk from disasters. And because the financial market has become increasingly disjointed from the real economy, it generates a further disconnection between asset managers and how the invested money is ultimately used.

(Source: UNISDR, adapted from

Clements-Hunt, 2012 Clements-Hunt, 2012 Clements-Hunt, P. 2012.,Investment, Finance and Capital Market Perspectives. The Blended Capital Group., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Clements-Hunt, P. 2012.,Investment, Finance and Capital Market Perspectives. The Blended Capital Group., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. Figure 12.1 The institutional investment value chain (simplified)

|

|