|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

|

|

227

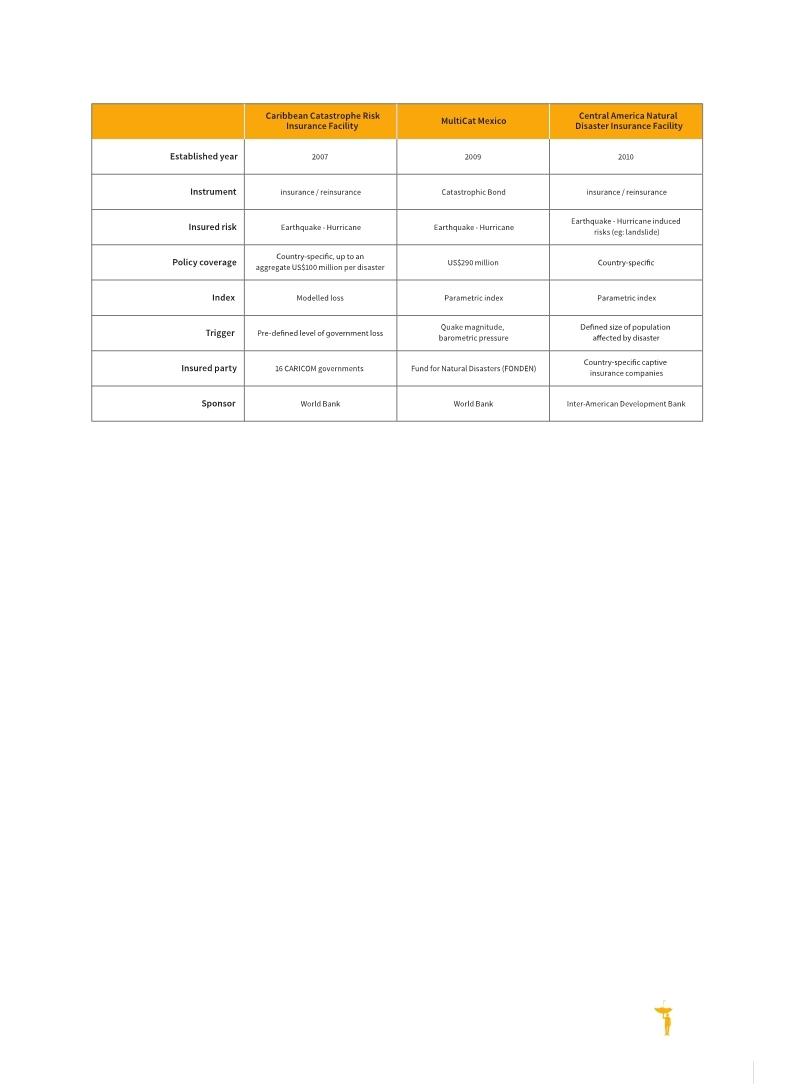

Table 15.1 Risk financing in selected countries

preparedness measures, including the National Disaster Prevention and Preparedness Fund and the Risk Financing Mechanism—the latter, a multi-million dollar contingent fund employed at the time of major droughts.

As highlighted in Chapter 7, the Pacific Catastrophic Risk Assessment and Financing Initiative (PCRAFI) is currently being developed and will be tested in the Marshall Islands. The PCRAFI assists the Pacific Island Countries (PICs) in shifting from post-disaster donor assistance to ex ante budget planning. The Pacific Disaster Reserve Fund is being established as a prototype risk pooling mechanism. This joint reserve mechanism would allow PICs to build up regional reserves against intensive disasters, supported by initial donor contributions and, if necessary, protected by global reinsurance. The Fund will provide incremental resources to restore essential services to countries after disasters and would help them in their recovery and reconstruction.

Colombia has emerged as a leader in its efforts to fully assess its contingent liabilities. It has begun to integrate liabilities emanating from disaster risk into its management of government liabilities; the effort

is led by the Deputy Directorate of Risk within its Ministry of Finance and Public Credit (MHCP) (Government of Mexico and World Bank, 2012

Government of Mexico and World Bank. 2012.,Improving the Assessment of Disaster Risks to Strengthen Financial Resilience., A Special Joint G20 Publication by the Government of Mexico and World Bank. 2012 International Bank for Reconstruction and Development / International Development., Washington DC,USA. Available at https://www.gfdrr.org/G20DRM. Although this momentum in selected countries is encouraging, the global debate still reflects a vision of disasters as exogenous shocks (G20/OECD, 2012

G20/OECD. 2012.,Disaster Risk Assessment and Risk Financing. A G20/OECD Methodological Framework., Paris,France: OECD.. Available at http://www.oecd.org/gov/risk/G20disasterriskmanagement.pdf.. (Source: UNISDR, based on Swiss Re, 2011

Swiss Re. 2011.,Economics of Climate Adaptation (ECA)-Shaping climate-resiliet development. A framework for decision-making., Zurich,Switzerland.. . |

|