|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

|

|

75

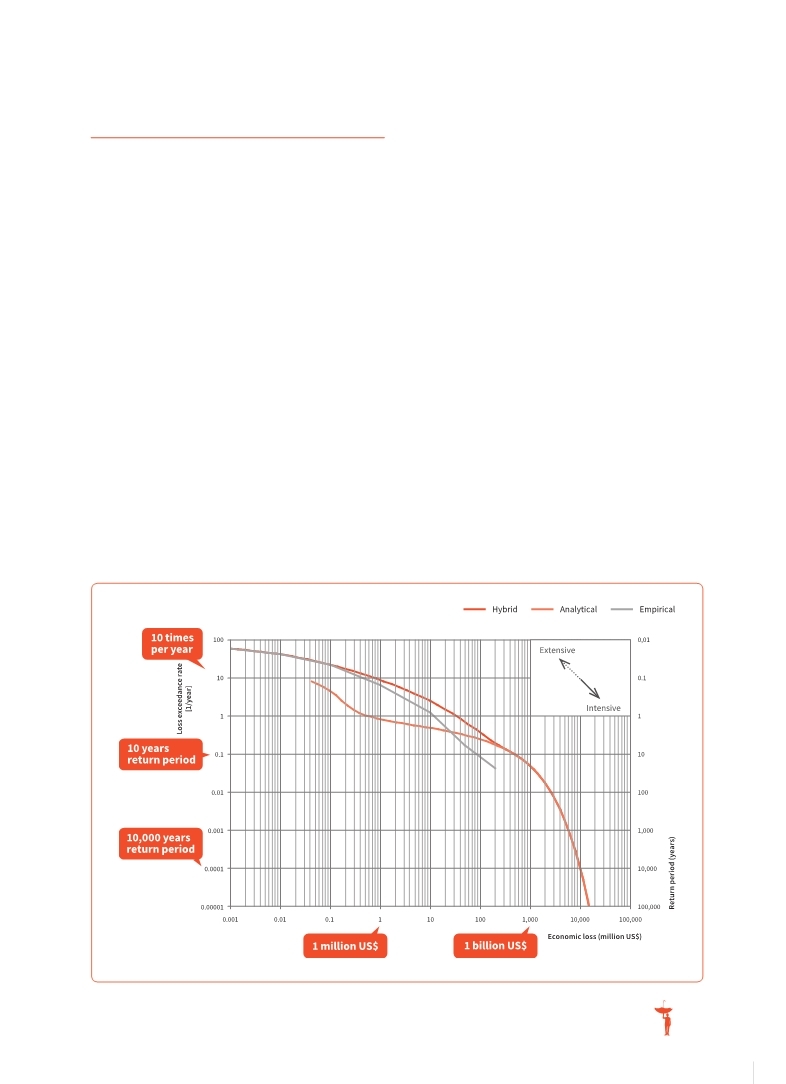

(Source: UNISDR, adapted from CIMNE et al., 2013b)

Figure 4.7 Hybrid loss exceedance curve for Guatemala

4.3

Hidden risk layers

A newly applied methodology to evaluate direct loss and damage from extensive disaster events allows extensive risk to be expressed as a loss exceedance curve. This enables countries to develop a more complete analysis of risk and of their contingent liabilities associated with disasters.

Extensive risks are rarely recorded, and therefore not taken into account in national risk assessments, which usually only focus on intensive risks. GAR11 (UNISDR, 2011

UNISDR. 2011.,Global Assessment Report on Disaster Risk Reduction: Revealing Risk, Redefining Development., United Nations International Strategy for Disaster Reduction., Geneva,Switzerland: UNISDR.. . Figure 4.7 shows the hybrid curve for Guatemala. The empirical curve, based on historical loss data,

provides information on largely extensive risks with return periods of up to approximately 30 years but does not capture intensive risks with longer return periods. Similarly, the analytical curve estimated using a probabilistic risk model does not capture much of the extensive risk with shorter return periods. The hybrid curve captures both.

Figure 4.8, based on hybrid loss exceedance curves for ten Latin American countries (CIMNE et al., 2013b ;

ERN-AL, 2011 ERN-AL, 2011 ERN-AL (Consortium Evaluación de Riesgos Naturales – America Latina). 2011.,Probabilistic modelling of disaster risk at global level: development of a methodology and implementation of case studies. Phase 1A: Colombia, Mexico and Nepal., Background Paper prepared for the 2011 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland. ERN-AL (Consortium Evaluación de Riesgos Naturales – America Latina). 2011.,Probabilistic modelling of disaster risk at global level: development of a methodology and implementation of case studies. Phase 1A: Colombia, Mexico and Nepal., Background Paper prepared for the 2011 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland. Click here to view this GAR paper. This kind of information is valuable to inform investments in disaster risk reduction. Often, the costs of

|

|